Claims: Adjusting, reopening, cancelling, and resubmitting

Reopening vs. adjustment

Reopenings are different from adjustment bills based on the following rules:

- Adjustment bills are subject to normal claims processing timely filing requirements (must be filed within one year of the date of service).

- Reopenings are subject to timeframes associated with administrative finality and are intended to fix an error on a claim for services previously billed. For example, claim determinations may be reopened within one year of the date of receipt of the initial determination, or within one to four years of the date of receipt of the initial determination upon a showing of good cause. Reopenings are only allowed after the normal timely filing period has expired.

Providers that need to correct or supplement information on paid (status / location P/B9997) and/or rejected (status / location R/B9997) claims may refer to the following:

Claim adjustment guidelines

- Providers may submit adjustment claims (type of bill (TOB) xx7) to correct errors or supplement a claim when the claim remains within the timely filing limits.

- Refer to claims timely filing guidelines for additional information.

Examples of timeliness for filing claim adjustments:

Timely filing period – Use TOB XX7

| Claim “through” date | Remittance advice date | Adjustment period (based on “through” date) |

|---|---|---|

| 10/01/24 | 11/01/24 | 10/01/24 – 09/30/25 |

| 10/01/24 | 03/31/25 | 04/01/25 – 09/30/25 |

| 10/01/24 | 09/30/25 | N/A – timely filing period has elapsed |

Claim reopening guidelines

- Providers billing electronic media (EMC) or direct data entry (DDE) claims must utilize the reopening process (TOB XXQ) when the need for correction is discovered beyond the claim timely filing limit; an adjustment bill is not allowed.

- Do not submit hard copy claims (via CMS-1450 form [UB-04]) with TOB XXQ.

- Refer to Part A claim reopenings beyond timely filing limit process changes to learn about the process changes for Part A claims reopening beyond the timely filing limit.

Examples of timelines for filing claim reopenings:

Beyond timely filing period – Use TOB xxQ

| Claim “through” date | Remittance advice date | Reopening period – ARC=R1 (based on RA date) | Reopening period – ARC=R2 (based on RA date) | Reopening period – ARC=R3 (based on RA date) |

|---|---|---|---|---|

| 10/01/21 | 11/01/21 | 10/01/22 - 10/31/22 | 11/01/22 - 10/31/25 | 11/01/25 and beyond |

| 10/01/21 | 03/31/22 | 10/01/22 – 03/30/23 | 03/31/23 – 03/30/26 | 03/31/26 and beyond |

| 10/01/21 | 09/30/22 | 10/01/22 – 09/30/23 | 10/01/23 – 09/29/26 | 09/30/26 and beyond |

Common reasons for adjusting and reopening claims

Providers are responsible for determining when a correction may be made to a paid (status / location P/B9997) or rejected (status / location R/B9997) claim. Please review the following for help with your determination.

Clerical or minor claim error correction

- Mathematical or computational mistake

- Transposed provider number or diagnostic code

- Inaccurate data entry

- Misapplication of fee schedule

- Computer error

- Duplicate claim denial when the party believes the claim was incorrectly identified as a duplicate

- Incorrect data item, such as provider number, use of a modifier, or date of service

Tolerance guidelines for adjusting hospitals and skilled nursing facilities (SNF) claims

- Number of inpatient days (including a change in the length of stay, or a different allocation of covered / non-covered days)

- Blood deductible

- Change in the Part B cash deductible of more than $1.00

- Inpatient hospital cash deductible of more than $1.00

- Servicing hospital or SNF provider number

- Hospital outlier payment

- Discharge status

Adding charge or service

- Providers may adjust claims (TOB xx7) to add charges or services when the claim is within the timely filing period.

- Providers are not permitted to add charges or services on an initial bill after the expiration of the time limitation for filing a claim.

- Review Claims timely filing for additional information on the timely filing guidelines.

Hospital diagnosis related group (DRG) claim adjustment

- Hospital adjustments to correct the diagnostic and procedure coding on the claim to a higher weighted DRG must be submitted, within 60 days of the paid remittance.

- Claim adjustments that result in a lower weighted DRG are not subject to the 60 day-requirement.

SNF health insurance prospective payment system (HIPPS) code adjustment

- SNF adjustments to change HIPPS code due to a minimum data set (MDS) correction must be completed within 120 days of the through date on the claim.

Medically denied claim

- It is not appropriate to adjust a claim that has a medical review (MR) denial (status / location D/B9997), or a paid claim with line item(s) denials.

- MACs will not allow claim lines that have been denied through a MR process (for example, MR, recovery audit contractor (RAC), Comprehensive Error Rate Testing program (CERT), office inspector general (OIG), quality improvement organization (QIO), etc.) to be reopened.

- Review how to identify medically reviewed adjudicated claims (reason codes 30940 and 30941) for the process on how to determine when a claim was medically reviewed, and how to make changes.

- Providers must submit an appeal request for a claim denial based on medical records, including failure to respond to a medical records request.

- Review Calculate the time limit for filing each level of appeal if you disagree with the denial reason and would like to request an appeal.

Additional reminders

- Do not adjust a claim in status / location P/B9996 (payment floor) until the claim has reached final disposition.

- Claims in status / location P/B7516 or R/B7516 (Medicare secondary payer post pay) will be held for at least 75 days (CMS cost avoidance savings) and cannot be adjusted until the claim has reached final disposition.

- Third party payer error in making primary payment does not constitute “good cause” for the purpose of reopening a claim beyond one year of the initial determination.

- A contractor’s decision to reopen or not reopen a claim, regardless of the reason for the decision, is not subject to an appeal.

- A reopening will not be granted if an appeal decision is pending or in process.

Adjustment and cancel claim data requirements

The following information is required on adjustment and cancel claims. This is not an all-inclusive list. Additional data elements may be required when adjusting or cancelling your claims.

Claims adjustment data requirements:

| Data description | Requirement details | CMS form 1450 (UB-04) Field Locator (FL) |

DDE MAP screen # Page # |

|---|---|---|---|

| Type of bill (TOB) | 3rd digit = 7 (TOB XX7) | FL 4 | MAP1711 Page 01 |

|

Claim change reason code or condition code |

D0 (zero) - Change in service dates DI – Change in charges D2 - Change in revenue codes, HCPCS, or health insurance prospective payment system (HIPPS) code-set D3 - Change in revenue codes, HCPCS, or HIPPS code-set D4 - Change in grouper input ICD diagnoses or procedure codes -- PPS inpatient hospital D7 - Change to make Medicare the secondary payer D8 - Change to make Medicare the primary payer D9 - Any other change -- remarks are required on the claim E0 (zero) - Change in patient status |

FL 18-28 | MAP1711 Page 01 |

| Document control number (DCN) | DCN is required for the claim being adjusted | FL 64 | MAP1711 Page 01 |

| Total charges | Delete and re-enter the recalculated total charges | FL 47 | MAP1712 Page 02 |

| Remarks | Remarks indicating the reason for the adjustment are required when condition code D9 is present | FL 80 | MAP1714 Page 04 |

- Select only one claim change reason code that best describes the reason for adjusting or cancelling the claim.

- Direct data entry (DDE) users should delete the total charges line (0001) and rekey the line with the recalculated total charges and non-covered charges.

Cancel claims data requirements:

| Data description | Requirement details | CMS form 1450 (UB-04) Field Locator (FL) |

DDE MAP screen # Page # |

|---|---|---|---|

| Type of Bill (TOB) | 3rd digit = 8 (TOB XX8) | FL 4 | MAP1711 Page 01 |

|

Claim change reason code or condition code |

D5- Cancel-only to correct the patient Medicare number or provider identification number D6 - Cancel-only to repay a duplicate payment or Office of Inspector General (OIG) overpayment -- includes cancellation of an outpatient bill containing services required to be included on the inpatient bill |

FL 18-28 | MAP1711 Page 01 |

| Document control number (DCN) | DCN is required for the claim being cancelled | FL 64 | MAP1711 Page 01 |

| Remarks | It is recommended that remarks are included indicating the reason for canceling the claim | FL 80 | MAP1714 Page 04 |

Rejected claims: Adjusting and resubmitting

Occasionally, claim rejects will post to the beneficiary’s records on the Common Working File (CWF). The most common effected rejection reason code range is 34XXX (Medicare secondary payer). If a claim reject has posted to the CWF, a new claim submission is subject to duplicate editing. Claim rejects that have posted to the CWF may be adjusted within the appropriate timeframe.

The following information is exclusively available for direct data entry (DDE) users.

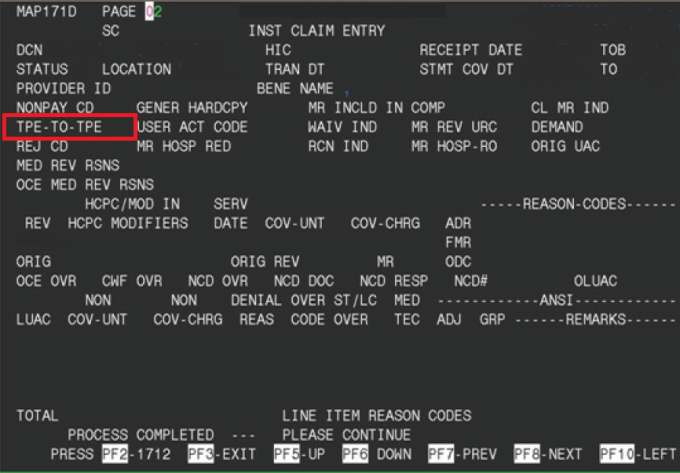

The tape-to-tape (TPE-TO-TPE) flag indicators in DDE will advise whether a claim has or hasn’t posted to the CWF. Refer to the TPE-TO-TPE field on claim page 2 or the MAP171D screen from the claim inquiry screen.

- The claim reject did not post to the CWF if the flag indicator is ‘X.’

- The claim reject posted to the CWF if the flag indicator is ‘ ‘ (blank).

References

- CMS IOM Pub. 100-04, Chapter 1 section 130, section 120

- Chapter 34 sections 10.4 and 10.6.2

- Pub. 100-05, Chapter 5 section 60.1.3.2.1

- Medicare Part A Direct Data Entry (DDE) Training Manual