Tips to prevent RTP 32400 to 32404

Prior to submitting your claim, verify the revenue code(s) and/or HCPCS or CPT code combination is correct, complete, and/or valid (as applicable).

The following reason codes are frequently associated with this edit:

- 32400 – HCPCS/CPT code is missing

- 32401 – HCPCS/CPT code is invalid

- 32402 – HCPCS/CPT code and revenue code combination is invalid

- 32403 – HCPCS/CPT code is invalid for date(s) of service (DOS)

- 32404 – HCPCS/CPT code is invalid

Click here for descriptions associated with Medicare Part A reason codes. Enter a valid reason code into the box and click the submit button.

Additional resources:

- Refer to our coding website page for additional guidance on procedure codes.

- Refer to the Medicare Billing: 837I and form CMS-1450 fact sheet for claim submission guidelines, coding, claim accuracy, and other resources.

Direct data entry (DDE)

Learn how to research detailed claim information and coding requirements through DDE:

Claim summary inquiry (12)

Revenue codes (13)

HCPC inquiry (14)

Refer to the Medicare Part A direct data entry (DDE) training manual for all field descriptors and additional guidance.

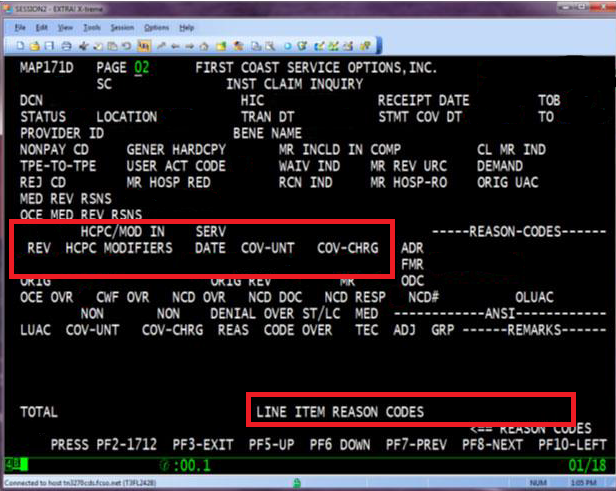

Claim summary inquiry (12)

Review detailed claim information, to identify line item(s) that resulted in the claim error.

- Open the claim and go to claim page 02 (MAP171)

- Press the ‘F2’ key and review the line item details (MAP171D)

- Review each line that failed with line item reason codes 32400-32404

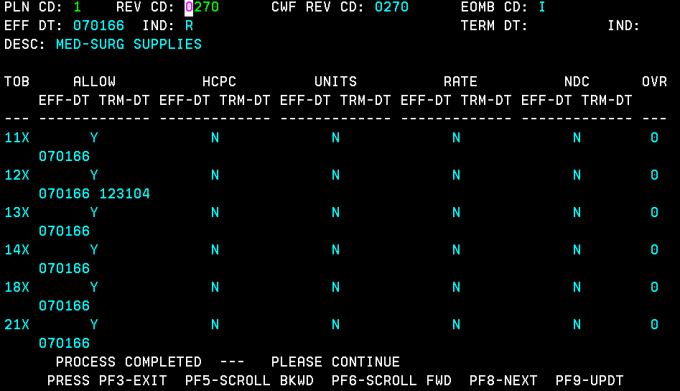

Revenue codes (13)

Utilize the revenue code inquiry screen when you need to determine:

- Effective and termination dates (if applicable)

- Allowable type of bills (TOB)

- If a HCPCS code is required

- If a unit is required

- If a rate is required

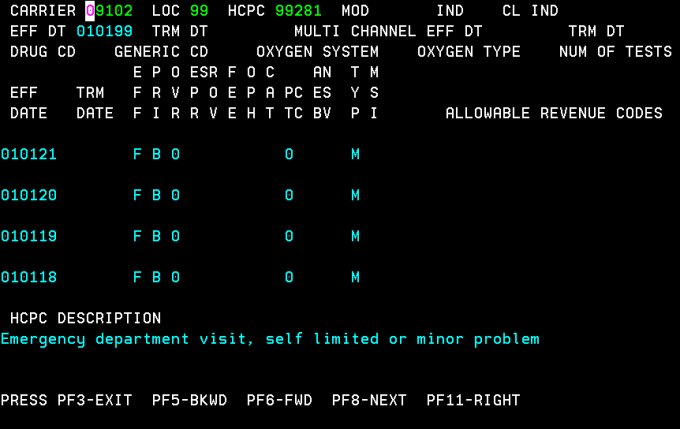

HCPC inquiry (14)

Utilize the HCPCS inquiry screen when you need to determine:

- Effective and termination dates (if applicable)

- Allowable revenue codes

- Note: When the allowable revenue codes field is blank, the system allows any revenue code for the keyed HCPCS.